The travails of one UK-based property company illustrate potential difficulties

Bulgaria remains less appealing to international companies than its larger neighbour Romania across the Danube, yet investment flows steadily into a variety of sectors, from automotive components and IT to logistics and food processing.

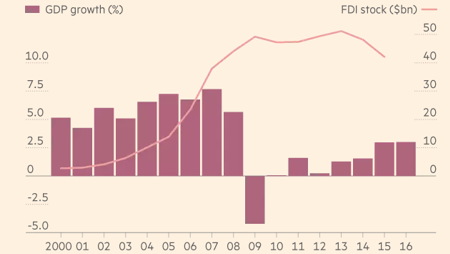

Foreign direct investment stock, a measure of the total amount of foreign investment in a country at a given time, has risen from $23bn in 2006, before Bulgaria joined the EU, to $42bn in 2015, although it is down from its 2013 peak of $51bn, according to Unctad, the UN body overseeing trade and development. The fall in investment was largely due to the collapse of a private Bulgarian bank which had several foreign shareholders and the shrinking of operations by subsidiaries of an Athens-based bank hit hard by the Greek crisis, according to an independent consultant in Sofia.

On the other hand, new investment in manufacturing and services has shown a modest increase rising from €1.2bn in 2010 to €1.6bn in 2015, according to data collected by InvestBulgaria, the government agency for promoting foreign investment.

Investors will be taking advantage of low wage costs and a flat tax rate of 10 per cent on corporate profits and personal income, the lowest in the EU.

“We’re a natural bridge between east and west . . . Companies can invest in Bulgaria and expand across Europe,” says Stamen Yanev, executive director of InvestBulgaria. He gestures towards a map of Bulgaria depicting a swath of special economic zones across the country where investors are allowed to buy land below market prices.

In regions of high unemployment, investors also enjoy tax breaks on reinvested profits and subsidies on social insurance payments, he says.

Efforts are under way to accelerate procedures for issuing of permits and licences to investors in manufacturing and services, long a source of friction with foreign companies preparing to enter the Bulgarian market.

The situation is already markedly different in the fast-growing technology sector: start-ups, outsourcing companies and software developers are all exempt from most licensing requirements.

“The IT sector in particular is getting serious investment partly because of the skilled workforce available but also because these companies don’t have to go through a permitting regime,” says Alex Nestor, vice-president of the American Chamber of Commerce in Sofia.

However, despite making progress with governance since EU accession in 2007, there is still much to be done.

“It’s well known that Bulgaria has problems with high-level corruption in politics and the justice system, we are publicly castigated by the EU in this respect. But successive governments have been reluctant to address this problem,” says a Sofia-based lawyer speaking on condition of anonymity.

Bulgaria is ranked 50th overall out of 138 countries in the World Economic Forum’s latest competitiveness report. But WEF ranks it at only 110th and 115th when it comes to independence of the judiciary and security of property rights.

Sofia-based lawyers advise their foreign clients preparing to sign a contract with a local partner to insist on a clause permitting arbitration outside Bulgaria in the case of a dispute. To reduce risk further, they also suggest setting up an investment partnership abroad, so that only the operating company is based in Bulgaria.

“When it comes to property rights outside the special economic zones our advice is to make sure that title deeds are translated and that a history of title transactions is compiled,” one lawyer says.

The travails of East Balkan Properties, a UK-based property company, underscore the risks associated with investing in a poorly regulated property market where there are doubts about judicial independence.

Until February, Glorient Investment Bulgaria, a local affiliate of East Balkan that specialises in building retail premises, was receiving rent regularly from 22 outlets of Technomarket, a Bulgarian electrical goods retailer from whom it bought the properties 10 years ago.

Investors benefit from low wage costs and a flat tax rate of 10% — the lowest in the EU

But now Glorient says NSN Investment, a company that acquired Technomarket early this year, is suing Glorient claiming its deals with the retailer are invalid and the properties still belong to Technomarket. Rents on the outlets have not been paid since the dispute began, according to Glorient’s lawyer.

“We’re extremely worried about this breach of property rights in an EU member state,” says Michael Uhler, East Balkan managing director. Glorient is contesting NSN’s claims in court in Bulgaria.

NSN could not be reached for comment about the dispute.

Despite the UK property owner’s current predicament, Sofia-based observers say the majority of partnerships between Bulgarian and international businesses now operate more smoothly than previously.

It helps that international chambers of commerce, sectoral business associations and western diplomats lobby actively on behalf of investors facing problems.

Copyright The Financial Times Limited 2016. All rights reserved. You may share using our article tools. Please don't cut articles from FT.com and redistribute by email or post to the web.